|

LISTEN TO THIS THE AFRICANA VOICE ARTICLE NOW

Getting your Trinity Audio player ready...

|

A new House Republicans tax proposal in the U.S. Congress, dubbed “One Big Beautiful Bill,” backed by President Donald Trump, could soon impose a 5% tax on every dollar you send back home.

The 5% excise tax would affect over 40 million people, including green card holders and individuals on nonimmigrant visas like H-1B, H-2A, and H-2B. U.S. citizens, however, would be exempt.

“I hope it doesn’t pass because it would be bad news for many people I know who have projects back home,” Larry (not his real name), an immigrant from Nigeria, said.

Summary of the Proposal

The proposed legislation would:

- Tax all remittance transfers out of the U.S. at a rate of 5%.

- Require the sender to pay the tax at the time of transfer.

- Hold money transfer companies like Western Union or Remitly responsible for collecting and sending the tax to the U.S. government.

Who Is Exempt?

Only U.S. citizens or nationals verified by certain licensed remittance providers will be exempt from this tax. To avoid paying the 5%:

- The sender must prove U.S. citizenship or national status.

- The remittance provider must have a formal agreement with the IRS to verify that status. (It’s unclear which providers are approved)

What If You’re a Citizen and Still Get Taxed?

According to the 387-page document, verified U.S. citizens or nationals who get taxed can claim a full refund when filing their taxes, but only if they provide their Social Security Number and complete the required documentation.

Why This Matters to Africans in the U.S.

African immigrants in the U.S. send billions of dollars every year to support their families, pay school fees, build homes, or invest in businesses across the continent. For many, remittances are more than financial support—they’re a lifeline.

This tax could:

- Increase the cost of sending money home by 5% instantly.

- Hit undocumented immigrants and legal residents the hardest, since they’re not eligible for exemptions or refunds.

- Force people to look for unregulated, riskier alternatives to avoid the tax.

Critics Say the Bill Unfairly Targets Immigrants

Advocacy groups argue this law is aimed squarely at immigrant communities. The exemption only applies to U.S. citizens or nationals, meaning:

- Green card holders, visa holders, refugees, and undocumented immigrants would still pay the tax.

- Those without Social Security Numbers would not qualify for the refund.

If passed, the new policy would effectively turn remittance payments—often made by the poorest working-class immigrants—into a target for taxation and an immigration control tool.

Supporters Say It’s About Accountability

Republican backers of the proposal say it will:

- Generate tax revenue from money leaving the U.S.

- Support government spending, potentially for border enforcement or anti-fraud efforts.

- Deter illegal immigration by making life harder for those sending money abroad.

Can a Citizen “help” a Friend?

House Republicans have included anti-conduit rules in the proposal to prevent individuals from avoiding the remittance tax through creative workarounds.

“With respect to any multiple- party arrangements involving the sender, a remittance transfer shall be treated as a financing transaction.” (Pg 329: Section 4475(e), Subchapter C—Remittance Transfers)

This clause invokes Section 7701(l) of the Internal Revenue Code, which allows the IRS to recharacterize multi-party transactions when they’re structured primarily to avoid tax.

These rules are designed to stop people from using multiple intermediaries or third-party arrangements to disguise or reroute remittance transfers in a way that would bypass the tax. For example, someone might try to send money through a friend or through layered business transactions to avoid being identified as the sender. The legislation treats all such indirect transfers as financing transactions, ensuring that the tax still applies no matter how complex or indirect the method used.

What Can You Do Now?

- Know your status: If you’re a U.S. citizen, you may be exempt, but you may still need to prove it.

- Keep receipts and documentation: Proper records will be essential if you plan to claim the refund.

- Consider alternative platforms: Some digital wallets or peer-to-peer apps may offer better clarity on fees and taxes.

- Contact your elected officials: Let them know how this law would impact your family and your homeland.

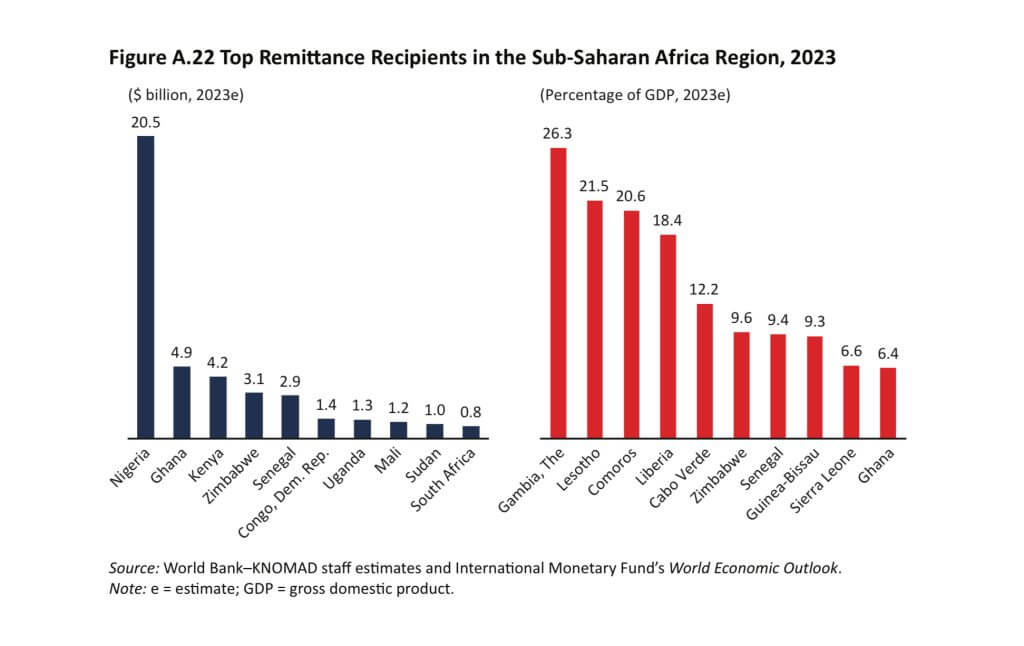

Remittances are a significant source of foreign exchange in many African countries. According to a World Bank report, Nigeria received more than $20 billion in remittances in 2023, while Ghana and Kenya received slightly under $5 billion.

If passed, the remittance tax would take effect on January 1, 2026.

LEAVE A COMMENT

You must be logged in to post a comment.